The Facts About Home Renovation Loan Uncovered

Table of ContentsSee This Report on Home Renovation LoanFacts About Home Renovation Loan UncoveredIndicators on Home Renovation Loan You Should KnowWhat Does Home Renovation Loan Mean?7 Simple Techniques For Home Renovation LoanUnknown Facts About Home Renovation Loan

In some cases lenders refinance a home to gain access to equity required to complete minor renovations. If your current mortgage equilibrium is below 80% of the current market worth of your home, and your household earnings sustains a bigger home loan amount, you might certify to refinance your mortgage with added funds.This enables you to complete the job needed on the home with your own funds. Once the improvements are total, the lending institution releases funds to you and your mortgage amount increases. As an example, you might purchase a home with a home mortgage of $600,000, and an improvement quantity of $25,000.

A home improvement car loan can provide fast financing and adaptable settlement choices to homeowners. Home renovation financings may come with higher prices and fees for borrowers with negative credit history. These lendings can help construct your credit report and boost the value of your home, however they also have possible downsides such as high fees and protected alternatives that put your properties at danger.

Home Renovation Loan Fundamentals Explained

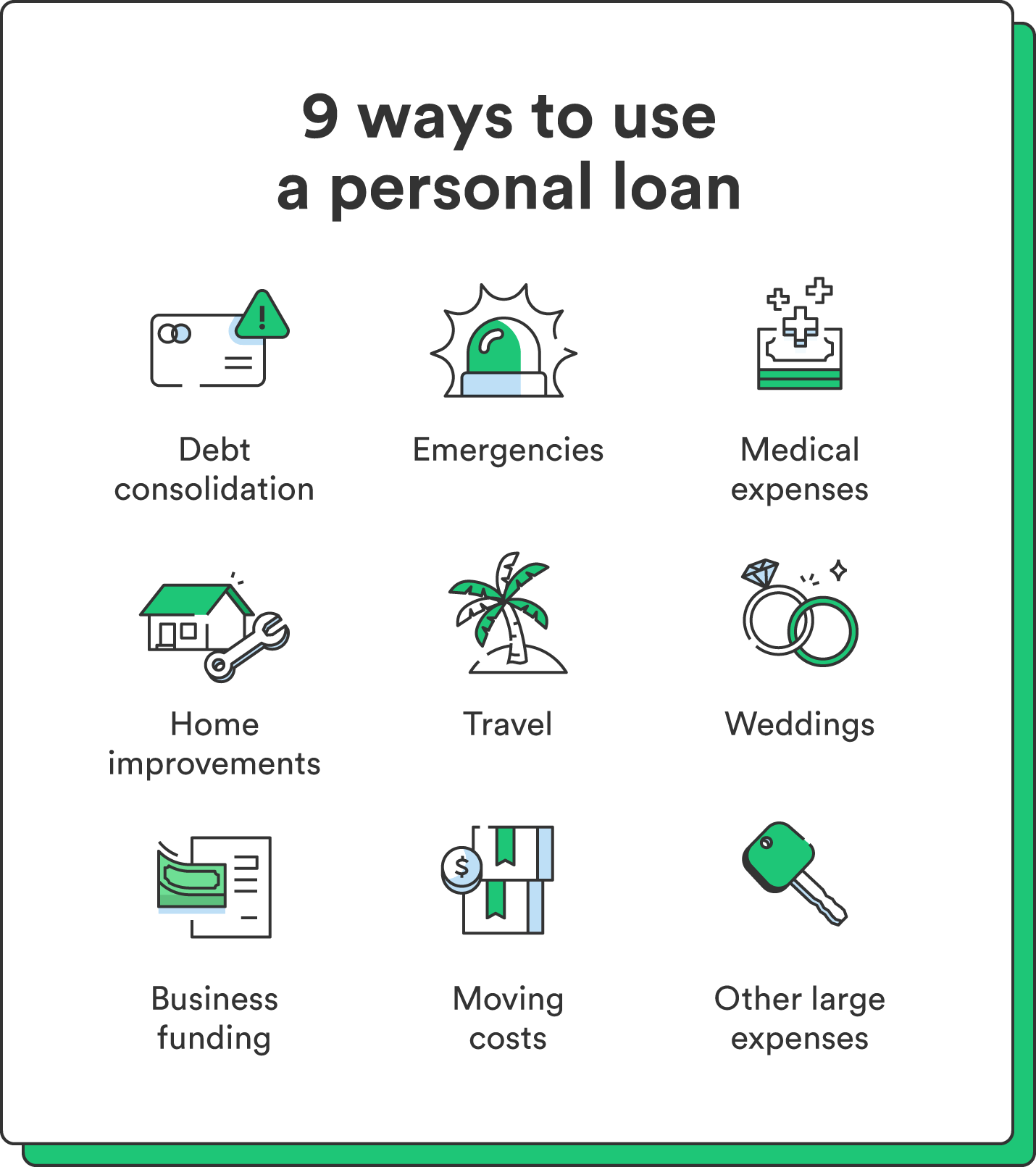

You might money every little thing from small improvements to cellar conversions. Personal lendings are one common kind of home renovation car loan, however various other types like home equity car loans and cash-out refinancing use their very own rewards. Like all lendings, home improvement fundings have downsides. If you don't have stellar credit report, it's most likely that you'll be used high interest rates and fees if accepted.

Home enhancement finances aren't for everybody. Factors like costs, high rates and difficult debt pulls can take away from the car loan's value to you and create financial stress and anxiety later on. Not every lender charges the very same fees. Your loan may have an source fee deducted from the overall quantity you receive or included to the amount you obtain.

The Buzz on Home Renovation Loan

Both can be avoided. But a prepayment charge makes it much more difficult to conserve money on rate of interest if you're able to pay in advance of timetable. Home enhancement funding interest prices can be as high as 36 percent specifically for those with poor credit report. The higher your interest price, the a lot more you will certainly have to invest every month to finance your home projects.

Some car loans are safeguarded either by your home's equity or by another property, like a savings or investment account. If you're incapable to pay your car loan and enter default, the lending institution can seize your security to please your financial obligation. Also if a secured funding features lower rates, the threat original site capacity is much higher which's an essential aspect to take into consideration.

And if you miss out on any repayments or default on your car loan, your loan provider is most likely to report this to the credit rating bureaus. Missed repayments can stay on your credit history report for up to seven years and the better your credit report was in the past, the more it will fall.

Unprotected home renovation financings normally have quick funding his explanation speeds, which might make them a far better funding option than some options. If you require to borrow a round figure of money to cover a project, a personal car loan might be a good concept. For recurring jobs, take into consideration a bank card, credit line or HELOC.

Excitement About Home Renovation Loan

There are several sorts of home renovation finances beyond just individual fundings. About 12.2. Unprotected individual car loan rates of interest are typically more look at this site than those of safeguarded funding kinds, like home equity fundings and HELOCs. Yet they provide some advantages in exchange. Financing times are much faster, because the lending institution doesn't have to examine your home's worth which additionally means no closing expenses.

You placed up your home as security, driving the passion price down. This additionally might make a home equity loan easier to qualify for if you have inadequate credit scores.

Present average interest price: Regarding 9%. A HELOC is a safe lending and a rotating credit line, implying you attract cash as needed. Rates of interest are usually reduced but generally variable, so they fluctuate with the marketplace. Similar to home equity loans, the biggest disadvantages are that you could shed your home if you can not pay what you owe which shutting costs can be costly.

Refinancing replaces your present mortgage with a brand-new home loan and rates of interest. Making use of a cash-out refinance, you would certainly secure a brand-new home loan for even more than you owe on your home and make use of the distinction to money your home enhancement job. But closing expenses can be high, and it may not make sense if rate of interest are greater than what you're paying on your existing mortgage finance.

The smart Trick of Home Renovation Loan That Nobody is Discussing

This government financing is assured by the Federal Real Estate Administration (FHA) and made especially for home renovations, improvements and fixings. The optimum amount is $25,000 for a single-family home, less than a lot of your various other alternatives. You might require to give security relying on your financing quantity. Yet if you're a low-to-middle-income homeowner, this might be the ideal approach.

These periods normally last between 12 and 18 months.

That makes this approach best for brief- and medium-term jobs where you have a great estimate of your expenses. Carefully take into consideration the possible influence that tackling more financial obligation will certainly carry your financial wellness. Also prior to comparing lending institutions and checking out the information, perform a financial audit to guarantee you can handle more financial obligation.

And do not fail to remember that if you pay out investments that have actually gone up in value, the cash will certainly be taxed as a funding gain for the year of the withdrawal. Which indicates you might owe money when you submit your tax obligations. If you will get a fixer top, you can include the amount you'll need to finance the restorations right into your home mortgage.

Home Renovation Loan for Dummies